Podcast Gallery

Dasceq in News

Is it Debt Collection or CollectTech?

A lot of changes have taken place as digital communication, technology, compliance and other related factors have taken a front seat in the collections’ industry.

READ MORE

Relevance of machine learning in digital collection.

As per a recent survey in 2021, 76% of enterprises have preferred and prioritized AI and ML integration projects over any other IT initiatives thus making ML as one of the popular ...

READ MORE

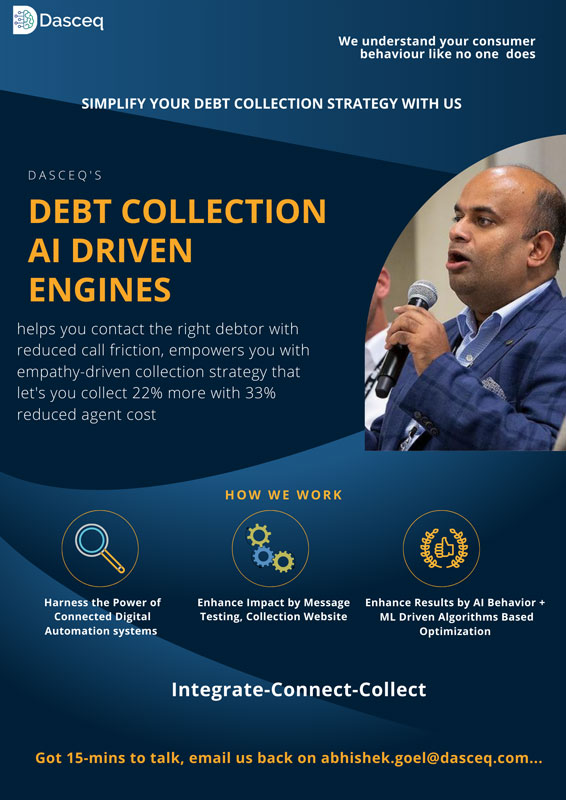

PODCAST: Series on digital collections begins with Dasceq’s Abhishek Goel

Dasceq founder and chief executive officer Abhishek Goel explains how artificial intelligence can help in collections during AIS 2019 in Raleigh, N.C. Photo by Jonathan Fredin.

READ MORE

Dasceq among 10 firms picked for 2020 FIS Fintech Accelerator

Dasceq founder and chief executive officer Abhishek Goel explains how artificial intelligence can help in collections during AIS 2019 in Raleigh, N.C. Photo by Jonathan Fredin.

READ MORE

Revolutionizing Debt Collection with an Expertise in Consumer Behaviour

With the rapid growth of consumer credit and the huge amount of financial data developing effective predicting models is very crucial.

READ MORE

Debt Connection Symposium & Expo 2019

Are you attending the Debt Connection Symposium in Las Vegas tomorrow? It's geared up for #collections professionals with compliance and accountability as major focus for discussions.

READ MORE

Dasceq among 10 firms picked for 2020 FIS Fintech Accelerator

Catch up with pur CEO, Abhishek Goel at Debt Connection Symposium to learn about the key elements in implementing #AI in the collection process.

READ MORE

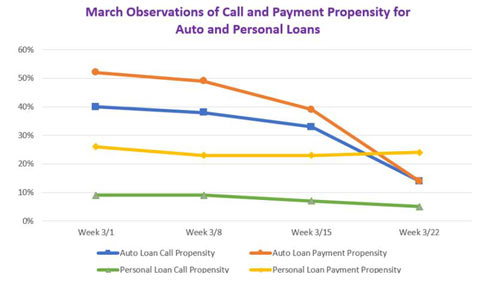

Auto and Personal Loan Data Related to Call and Payment Propensities during COVID

We have the unique ability at Dasceq to segment delinquent accounts into multiple Call and Payment...

READ MORE

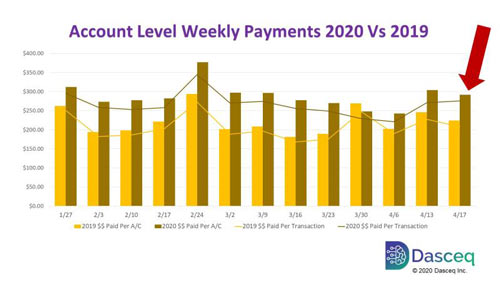

The Impact of the Stimulus Checks on Automotive and Personal Loans

We tracked weekly payments from the last week of January through the third week of April of 2020...

READ MORE

FIS Selects Ten Startups for 2020 Fintech Accelerator Program

Financial technology leader FIS® (NYSE: FIS) and The Venture Center have announced the ten companies selected to participate in the 2020 FIS Fintech Accelerator program.

READ MORE

Using A.I. in Collections Decisions with Dasceq's Abhishek Goel

Joel is joined by Abhishek Goel, Founder of the A.I. firm, Dasceq, to discuss the benefits of using A.I. in your collections process, including why humans...

READ MORE

Future of digital collections with Dasceq founder & CEO

CARY, N.C. — Auto Fin Journal recently reconnected with Abhishek Goel, the founder and chief executive officer of Dallas-based Dasceq, a firm that specializes accounts...

READ MORE[/vc_section]

Video

Auto Intel Summit 2022: Digital Dealer Solutions For Online Car Buyers

Using A.I. in Collections Decisions with Dasceq’s Abhishek Goel.

Joel is joined by Abhishek Goel, Founder of the A.I. firm, Dasceq, to discuss the benefits of using A.I. in your collections process, including why humans will always be a part of the equation, the benefits of moving from digital ‘bullying’ to digital ‘engagement’ and why it’s a good idea to rely on experts to implement programs outside of your own expertise.

Dasceq is on a mission to humanize the credit collections industry (Full Interview)

Dasceq is not just another AI company. Abhishek Goel, founder and “Chief Behavior Expert” sat with Lee Razo to talk about how Dasceq makes use of its unique combination of deep industry knowledge and experience with the latest AI and machine learning techniques.

Trial by fire and the role of the “Chief Behaviour Expert” at Dasceq

Abhishek Goel tells Lee about how one of his earliest career experiences shaped the way he learned to solve problems in the credit collection industry and ultimately led him to start Dasceq.

How technology improves customer experience and in turn improves collections efficiency.

Abhishek describes how Dasceq has taken a different approach to improving credit collection results by focusing on improving the customer experience for both the sides of the equation.

Compliance is an opportuntiy to create new channels of communication with consumers.

Abhishek explains how Dasceq strives to understand current digital behaviors in order to create better communication channels between collectors and consumers.

How Dasceq works with customers to gain trust and deliver results.

Dasceq is not interested in simply going after “low-hanging fruit”. Using a combination of AI and deep industry experience, they help creditors collect from their most difficult consumers.

Protecting consumer privacy by using alternative data sources for AI analysis.

Dasceq does not rely on the traditional sources of credit data (i.e. the “big three” credit reporting agencies). Instead they use AI and machine learning techniques on data provided directly from their customers containing no PII (personally identifiable information).

From the finance industry to AI: The story of Dasceq.

In this clip Abhishek tells the story of how working in the front lines of the finance industry ended up steering him into the technology industry and eventually founding Dasceq in 2017. He – and Dasceq – is now on a mission to fundamentally improve and humanize the credit.