DigiConnct™

Next Generation Digital Collect Tech

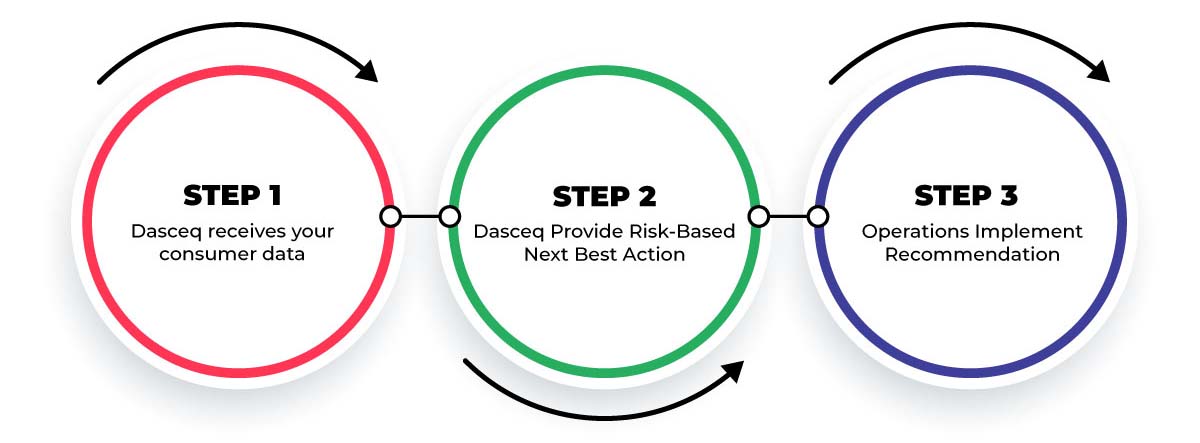

Using the SmartAI framework and enabling the use of 1000+ in-built variables, Dasceq’s Digiconnct™ brings you solutions to help improve recovery rates, while simultaneously improving the brand experience and customer loyalty. With a significant size of historic data, Digiconnct™ becomes one-stop solution for debt collection, which includes data enrichment module sources, accelerated Digital streamlines and simplified data collection, connection and distribution across all channels and devices. This helps you collect an average of 22% more with up to 33% less agent cost. Our solutions are focused on analyzing behavior, detecting anomalies and predicting future payments and delinquencies.

Collects Digitally on your Behalf

With deep-seed data mining and 1000+ consumer variables, we cannot go wrong in bringing the ROI with a great customer experience.

Intelligent segmentation and prioritization of accounts

This, along with prime-time recommendations for reach out makes it less frequency of calls and lesser drop-outs, connecting you to the right person in the FPOC.

Automated Portals & Pattern Recognition For Predicting likely Outcomes

Our algorithm identifies trends, anomalies, and opportunities. Detects early delinquency, and potential threats reducing the chances of falling into spam.

Cataloging the historical engagement patterns to establish legitimate interest (GDPR), implied consent, and geo-tagging

Relies on the digital data obtained from cookie and link tracking or the e-mail authentication process, thus providing additional information about the socioeconomic status.